Regulatory Landscape 🌐

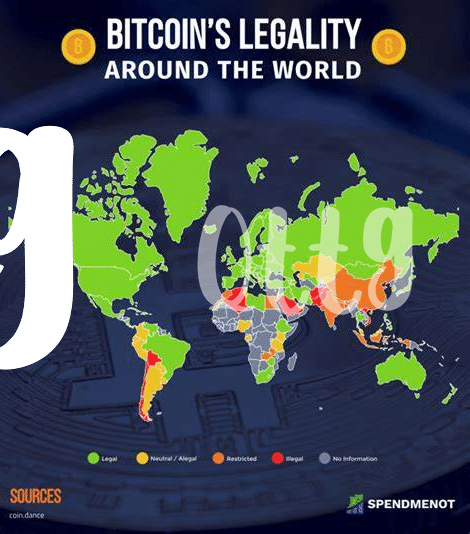

In Sudan, the regulatory landscape surrounding Bitcoin investment is complex, with evolving policies and guidelines shaping the market. Government agencies are scrutinizing the implications of digital currencies on traditional financial systems, seeking to strike a balance between encouraging innovation and mitigating potential risks. The dynamic nature of regulations in this space creates uncertainty for investors and businesses, underscoring the importance of staying abreast of the latest developments to navigate the evolving regulatory terrain effectively.

As Sudan navigates the intersection of technology and finance, the regulatory environment for Bitcoin investment plays a crucial role in shaping the digital economy. Stakeholders are actively engaged in discussions to establish a framework that fosters responsible use of cryptocurrencies while safeguarding the interests of consumers and the broader financial system. Clear, transparent regulations are essential to providing a solid foundation for the growing ecosystem of Bitcoin investments in Sudan, instilling trust and confidence among market participants.

Impact on Financial Inclusion 💸

The integration of Bitcoin investment in Sudan faces a complex regulatory landscape, shaping its accessibility and use. Financial inclusion stands out as a key aspect influenced by these regulations, impacting the participation of individuals from various socioeconomic backgrounds in the digital currency market. Understanding these dynamics is crucial to develop strategies that promote inclusivity and equitable opportunities for all stakeholders in the evolving financial ecosystem. By navigating these challenges with innovation and education, the future holds promising prospects for enhancing financial inclusion through Bitcoin investments in Sudan.

Risks and Concerns 🚨

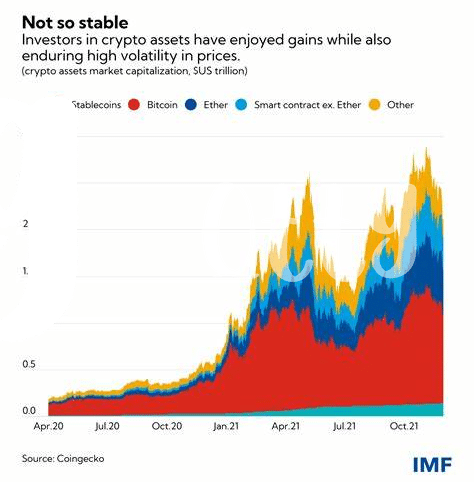

Bitcoin investment in Sudan presents several risks and concerns that need to be carefully addressed. These include potential for fraud and scams, lack of regulatory oversight, price volatility, and concerns about money laundering and illicit activities. Additionally, the security of digital wallets and exchanges is a significant concern, considering the history of cyberattacks in the cryptocurrency space. Addressing these risks is crucial for ensuring the long-term sustainability and adoption of Bitcoin in Sudan.

Potential for Innovation 💡

Within the realm of Bitcoin investment lies a realm of untapped potential waiting to be harnessed. Innovation in this space is not limited by traditional constraints, paving the way for new financial tools and services to emerge. The decentralized nature of cryptocurrencies opens doors for creative solutions that could revolutionize how we think about and interact with money. As we navigate the ever-evolving landscape of digital assets, the potential for innovation remains a driving force behind the growth and advancement of the cryptocurrency ecosystem.

For more insights on the legal framework surrounding Bitcoin investments in various regions, including South Korea, check out this detailed analysis on bitcoin investment funds regulation in South Korea.

Public Awareness and Education 📚

In order to foster a deeper understanding of Bitcoin investment in Sudan, efforts must be made to enhance public awareness and education. This includes disseminating clear and accessible information about the risks and benefits associated with cryptocurrency. By organizing workshops, webinars, and informational campaigns, individuals can be empowered to make informed decisions regarding Bitcoin investments. Moreover, collaboration between regulatory bodies, financial institutions, and educational institutions can play a crucial role in equipping the public with the knowledge needed to navigate the evolving landscape of digital currencies.

Future Outlook and Recommendations 🔮

The future of Bitcoin investment in Sudan holds immense potential for growth and transformation. In order to navigate regulatory challenges effectively, it is crucial for policymakers to stay abreast of global trends and best practices. Recommendations include fostering dialogue between regulatory bodies and industry stakeholders, enhancing transparency and accountability in the sector, and prioritizing investor protection. By proactively addressing these issues, Sudan can position itself as a hub for responsible and sustainable cryptocurrency investment.

Insert link here: Bitcoin Investment Funds Regulation in Somalia