Understanding the Risks 📉

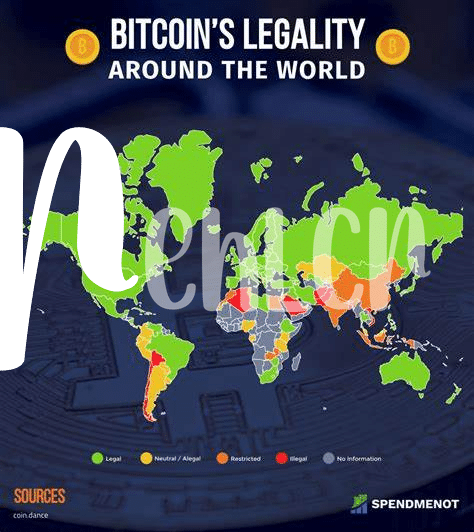

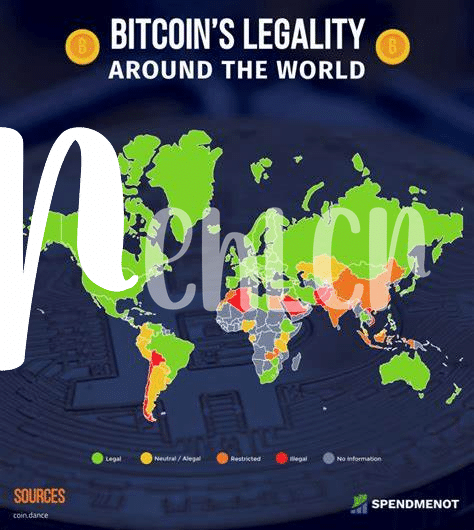

Investing in Bitcoin funds entails various risks that investors must grasp. Price volatility, regulatory uncertainties, and security vulnerabilities are factors to consider. Understanding these risks is crucial for making informed investment decisions. By acknowledging the potential downside, investors can better navigate the complexities of the cryptocurrency market with a more cautious approach.

Researching Different Funds 📊

When delving into the world of Bitcoin investment funds, it is crucial to thoroughly explore the landscape of available options. Each fund comes with its unique characteristics, such as investment strategies, risk levels, and potential returns. Researching different funds allows investors to gain a comprehensive understanding of what each fund offers and how it aligns with their investment goals. By conducting thorough research and comparing various options, investors can make informed decisions that are tailored to their financial objectives.

Evaluating Past Performance 📈

When evaluating past performance of Bitcoin funds in STP, it’s essential to dive deep into historical data, tracking how each fund has fared over time. Look for consistent growth patterns and stability, as these could indicate a reliable investment option. Analyzing performance trends can provide valuable insights into how a fund has navigated market fluctuations and volatility, helping you make informed decisions for your investment strategy. Past performance offers a window into how a fund may perform in the future, making it a crucial factor to consider before diving into Bitcoin investments.

Examining Fee Structures 💸

When considering investment in Bitcoin funds, it’s essential to carefully examine the fee structures associated with each option. Understanding the fees involved can have a significant impact on your overall returns. High fees can erode your profits over time, so it’s crucial to compare and contrast the fee structures of different funds. This diligent assessment will help you make informed decisions and choose the fund that aligns best with your financial objectives. To delve deeper into the challenges and opportunities surrounding the regulation of Bitcoin investment funds in Saint Vincent and the Grenadines, you may find this insightful article from WikiCrypto News particularly valuable. [Bitcoin investment funds regulation in Saint Vincent and the Grenadines](https://wikicrypto.news/challenges-and-opportunities-in-regulating-bitcoin-funds-in-samoa)

Considering Diversification 🔄

When investing in Bitcoin funds, it is crucial to consider diversification as a key strategy. Diversification involves spreading your investments across different types of assets to reduce risk. In the volatile world of cryptocurrencies, diversifying your Bitcoin fund investments can help protect your portfolio from major losses. By allocating your funds to a mix of assets, such as stocks, bonds, and other cryptocurrencies, you can create a more balanced investment approach that can potentially yield higher returns while mitigating potential risks.

Seeking Professional Advice 📝

When it comes to investing in Bitcoin funds, seeking professional advice is paramount. A knowledgeable financial advisor can provide valuable insights on the intricacies of the market, potential risks to watch out for, and the most suitable investment options based on individual goals and risk tolerance. Their expertise can help navigate the volatile nature of cryptocurrency investments and guide towards making informed decisions. In addition to conducting personal research, consulting with a professional can offer a well-rounded perspective that may enhance the overall investment strategy.