Regulatory Framework 📜

A robust regulatory framework is essential for the effective operation of Bitcoin investment funds in Libya. This framework provides the necessary guidelines and rules to ensure compliance with local laws and regulations, promoting transparency and investor protection in the evolving digital asset landscape. Understanding and adhering to these regulations is paramount for the successful establishment and operation of investment funds in the cryptocurrency sector.

Licensing Requirements 📋

When starting a Bitcoin investment fund in Libya, understanding and adhering to licensing requirements is crucial for compliance. These requirements involve the necessary permits and authorizations from regulatory bodies in the country. To obtain a license, firms often need to meet specific criteria related to capital requirements, transparency, and operational standards. Engaging with the licensing process early on is essential for ensuring that the fund operates within the legal framework set forth by Libyan authorities, providing a solid foundation for its activities in the burgeoning cryptocurrency market.

Ensuring compliance with licensing regulations not only demonstrates a commitment to operating ethically and transparently but also enhances the fund’s credibility among potential investors. By meeting these regulatory obligations, Bitcoin investment funds can foster trust and credibility in a rapidly evolving market environment, positioning themselves for long-term success and sustainability.

Custody and Security 🛡️

Custody and security are critical aspects when setting up a Bitcoin investment fund, ensuring the safekeeping of digital assets. Implementing robust security measures, such as cold storage solutions and multi-signature wallets, is essential to protect against cyber threats and unauthorized access. Regular security audits and continuous monitoring help maintain the integrity of the fund’s holdings, building trust with investors and safeguarding against potential risks.

Due Diligence Procedures 🔍

When conducting due diligence procedures for Bitcoin investment funds in Libya, it is crucial to meticulously assess and verify all relevant information. This involves rigorously examining the backgrounds of potential investors, ensuring compliance with regulatory requirements, and assessing the risks associated with each investment opportunity. By conducting thorough due diligence, investment fund managers can mitigate potential risks, safeguard against fraudulent activities, and enhance the overall integrity of their operations.

Moreover, establishing comprehensive due diligence procedures can instill confidence among investors, regulators, and stakeholders, ultimately fostering a trusted and transparent investment environment in Libya. Emphasizing proactive due diligence not only protects the interests of the fund and its investors but also contributes to the long-term sustainability and success of Bitcoin investment endeavors in the country.

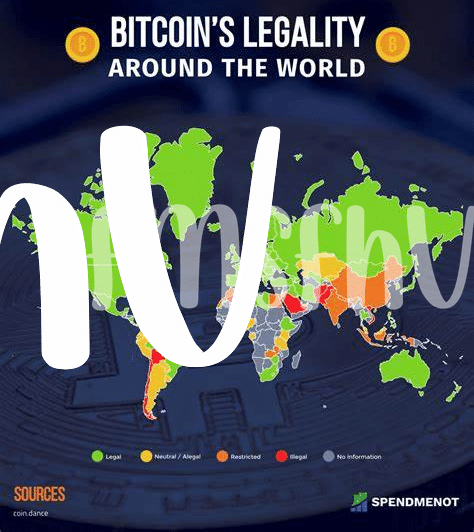

Bitcoin investment funds regulation in Libya

Risk Management Strategies ⚖️

Effective risk management is crucial in the volatile world of Bitcoin investment funds. Implementing robust strategies to identify, assess, and mitigate risks is key to safeguarding assets and ensuring investor trust. Diversification, thorough market analysis, and staying informed about regulatory changes are essential components of a successful risk management framework. By proactively addressing potential threats, investment funds can navigate uncertainties and protect their stakeholders’ interests.

Compliance Monitoring and Reporting 📊

When it comes to Compliance Monitoring and Reporting 📊, it is crucial for Bitcoin investment funds in Libya to establish robust processes. Regularly monitoring for compliance ensures that all regulatory requirements are being met, helping to mitigate risks and maintain the fund’s integrity. Detailed reporting mechanisms effectively communicate this compliance status to relevant stakeholders, fostering transparency and accountability within the organization. By prioritizing Compliance Monitoring and Reporting 📊, Bitcoin investment funds in Libya can demonstrate their commitment to operating within legal boundaries and upholding industry standards.

To learn more about bitcoin investment funds regulations in other countries, check out the bitcoin investment funds regulations in Kyrgyzstan.